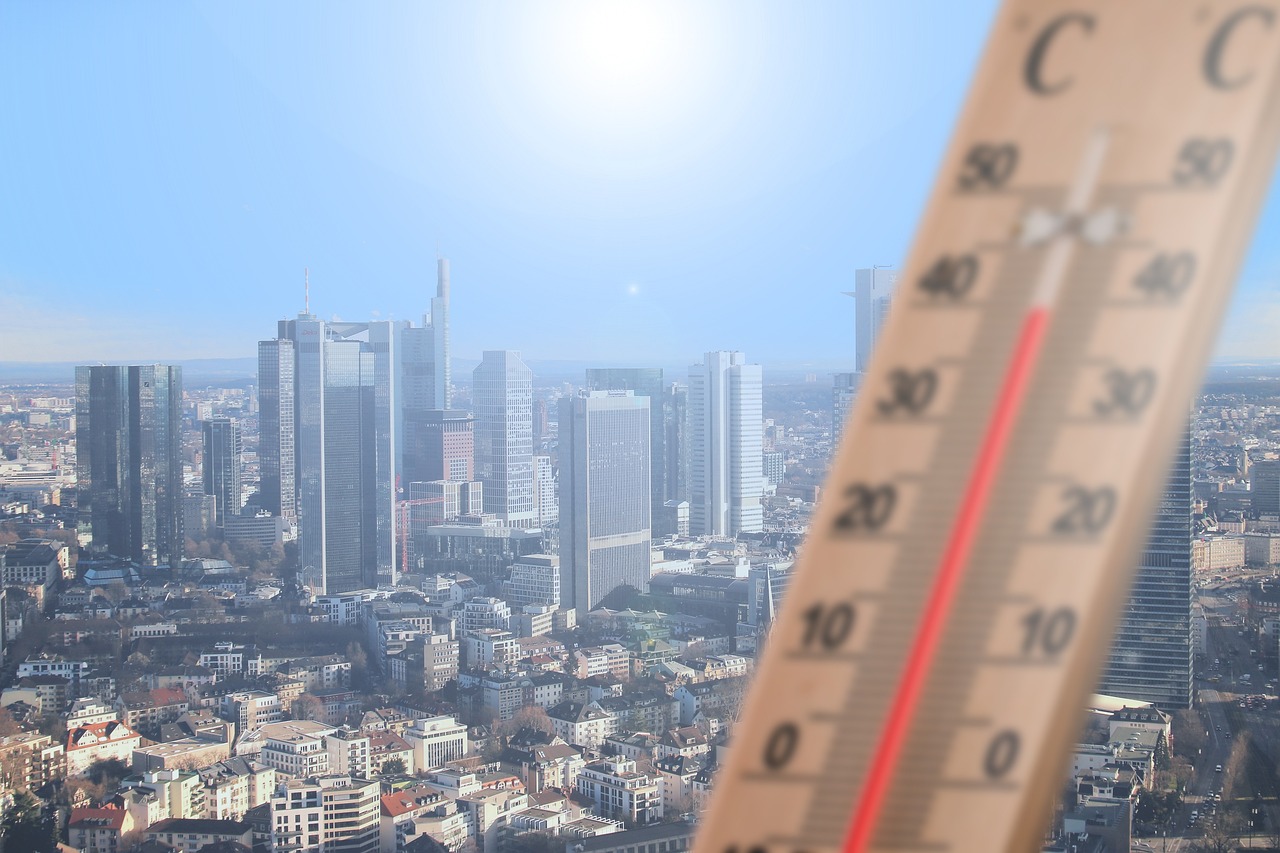

Climate Change: The Driver behind Rising Commodity Prices

Climate change is not just a buzzword; it's a reality that is reshaping our world in profound ways. One of the most significant impacts of this global phenomenon is its effect on commodity prices. As the climate continues to change, we are witnessing a dramatic shift in the prices of essential goods that we rely on every day. From food to energy, the costs of commodities are on the rise, and understanding the reasons behind this trend is crucial for consumers, businesses, and policymakers alike.

So, what exactly is driving these rising prices? The answer lies in a complex interplay of factors, including extreme weather patterns, changing agricultural yields, and the overall dynamics of the market. As we delve deeper into this topic, it becomes clear that climate change is not just an environmental issue; it is also a significant economic challenge that affects everyone, regardless of where they live.

One of the most immediate effects of climate change is its impact on agriculture. Farmers are facing unprecedented challenges due to shifting weather patterns and extreme conditions. For instance, droughts, floods, and heatwaves can devastate crop yields, leading to food shortages and, consequently, increased prices. In fact, studies have shown that climate change could reduce crop yields by up to 30% in some regions. This not only threatens food security but also drives up the costs of staples such as wheat, corn, and rice, making it harder for families to afford basic necessities.

Additionally, the transition to renewable energy sources is reshaping the energy market, further influencing commodity prices. As governments and industries push for greener alternatives, the demand for fossil fuels is being challenged. This shift can lead to both increased costs for traditional energy sources and a rise in prices for commodities linked to renewable technologies. For example, the demand for lithium and cobalt, essential components in batteries for electric vehicles, is skyrocketing. As a result, the prices of these commodities are also climbing, reflecting the changing landscape of energy consumption.

Moreover, government policies aimed at combating climate change play a crucial role in this scenario. Regulations designed to reduce carbon emissions often lead to higher costs for fossil fuels. These regulations can create a ripple effect throughout the economy, impacting everything from transportation costs to the price of goods. As businesses adapt to these new regulations, they may pass on the increased costs to consumers, resulting in higher prices for everyday products.

Technological innovations are also a double-edged sword in the context of climate change and commodity prices. While advancements in energy production and storage can lower costs in the long run, they can also introduce volatility into the market. New technologies often lead to speculation, as traders react to emerging trends and forecasts related to climate change. This speculation can create significant fluctuations in commodity prices, making it challenging for businesses to plan for the future.

Another critical factor to consider is water scarcity, which is exacerbated by climate change. Water is a vital resource for both agriculture and industry, and as it becomes increasingly scarce, the prices of commodities reliant on water resources are likely to rise. For instance, agricultural water usage is essential for crop production. As water becomes limited, the costs associated with irrigation and crop management will increase, inevitably affecting commodity prices. Similarly, industries that depend on water for production may face rising operational costs due to increased competition for this precious resource.

Finally, we cannot ignore the impact of global supply chain disruptions caused by climate change. Natural disasters linked to climate change can wreak havoc on transportation and production systems, leading to bottlenecks and shortages. These disruptions result in increased costs for businesses and consumers alike. Furthermore, geopolitical tensions exacerbated by climate-related issues can complicate the global supply chain, leading to trade restrictions and tariffs that further drive up prices.

In summary, climate change is a multifaceted issue that has far-reaching implications for commodity prices. From agriculture to energy, the effects are undeniable and pervasive. As we navigate this new reality, it is essential to stay informed and prepared for the challenges that lie ahead. Understanding the dynamics at play can empower consumers and businesses to make informed decisions in an ever-changing economic landscape.

- How does climate change specifically affect agricultural prices? Climate change leads to extreme weather events that can reduce crop yields, resulting in higher prices for agricultural commodities.

- What role do government policies play in commodity pricing? Government regulations aimed at reducing carbon emissions can increase costs for fossil fuels, which often translates to higher prices for consumers.

- How does water scarcity influence commodity prices? As water becomes scarce, the costs associated with irrigation and industrial use rise, driving up the prices of commodities that rely on water resources.

- Can technological innovations stabilize commodity prices? While new technologies can lower costs, they can also create market volatility due to speculation and changing demand dynamics.

Impact on Agriculture

Climate change is like a double-edged sword, cutting through the fabric of agricultural productivity. As the planet warms, we are witnessing dramatic fluctuations in crop yields that can leave farmers scratching their heads in disbelief. Extreme weather events, such as droughts, floods, and hurricanes, are becoming more frequent and intense. These events not only threaten the **stability** of food supplies but also significantly drive up prices for essential commodities. Imagine a farmer who has spent months nurturing his crops, only to have them wiped out by an unexpected flood. This scenario is becoming all too common, and it sends ripples through the entire food supply chain, ultimately affecting consumers at the grocery store.

Moreover, shifting climate zones are forcing farmers to adapt to new growing conditions that they may not be familiar with. For instance, crops that once thrived in certain regions may now struggle to survive due to altered rainfall patterns and temperature extremes. This adaptation process can be costly and time-consuming, leading to increased operational expenses that are often passed on to consumers. According to recent studies, the impact of climate change on agriculture could lead to a staggering increase in food prices globally.

Take a look at the following table that summarizes the effects of climate change on various agricultural factors:

| Factor | Impact |

|---|---|

| Crop Yields | Fluctuations due to extreme weather events |

| Water Availability | Increased scarcity affecting irrigation |

| Pest and Disease Pressure | Higher risks due to warmer temperatures |

| Soil Health | Degradation from extreme weather and erosion |

In addition to these direct impacts, climate change also poses indirect threats to agriculture through the lens of **food security**. As food prices rise, lower-income households find it increasingly difficult to afford basic necessities. This economic strain can lead to increased food insecurity, where families are forced to make tough choices between essential items. The cycle of climate change and agricultural disruption creates a complex web of challenges that can leave us all feeling vulnerable.

Furthermore, the agricultural sector is not just about crops; livestock is equally affected. Heat stress can reduce livestock productivity and fertility, while changing pasture conditions can affect feed availability. Farmers must adapt their practices to ensure that their animals remain healthy and productive, which often requires additional investment in resources and technology. The question arises: how can we effectively support our farmers during these challenging times? Collaboration between governments, NGOs, and the agricultural community is essential to develop strategies that promote resilience against climate change.

Ultimately, the impact of climate change on agriculture is profound and far-reaching. It's a reminder that we are all interconnected in this ecosystem, and the health of our planet directly influences our ability to feed ourselves. As we move forward, it's crucial to prioritize sustainable practices and innovative solutions that can help mitigate these impacts. After all, the future of our food system depends on the actions we take today.

- How does climate change affect crop yields?

Climate change leads to extreme weather events and shifting climate zones, which can disrupt traditional growing patterns and reduce crop yields. - What role does water scarcity play in agriculture?

Water scarcity limits irrigation options for farmers, leading to lower productivity and higher prices for crops. - Are livestock also affected by climate change?

Yes, livestock can suffer from heat stress and reduced feed availability, impacting their health and productivity. - What can be done to support farmers facing climate challenges?

Collaboration between governments, NGOs, and agricultural communities is essential to develop strategies for resilience and sustainability.

Energy Prices and Climate

As climate change accelerates, it is reshaping the energy landscape in profound ways. The shift towards renewable energy sources is not just a trend; it is becoming a necessity for sustainability. This transition impacts energy prices significantly, as the market adapts to new realities. Traditional fossil fuels, once the backbone of energy production, are facing increased scrutiny and regulatory pressures, which can lead to fluctuating prices. In this dynamic environment, understanding how these changes affect commodity prices is crucial.

The transition to renewable energy is like turning a massive ship in the ocean; it takes time, effort, and coordination. As governments and industries invest in solar, wind, and other renewable technologies, the demand for fossil fuels is likely to decrease over time. However, this shift does not happen overnight. In fact, it often leads to a dual market where both renewable and traditional energy sources coexist, creating a complex pricing structure. For instance, while the cost of solar panels has decreased significantly, the initial investment in infrastructure can still be high, affecting overall energy prices.

Moreover, government policies aimed at reducing carbon emissions play a crucial role in shaping energy prices. Regulations can increase operational costs for fossil fuel companies, which are often passed on to consumers in the form of higher prices. On the flip side, subsidies for renewable energy can lower costs, making sustainable options more appealing. This tug-of-war between fossil fuels and renewables creates a volatile market landscape. To illustrate this, consider the following table that outlines the impact of various factors on energy prices:

| Factor | Impact on Energy Prices |

|---|---|

| Government Regulations | Can increase costs for fossil fuels, potentially raising prices for consumers. |

| Renewable Energy Adoption | Can lower long-term costs, but initial investments may spike prices temporarily. |

| Market Demand | Shifts in demand towards renewables can decrease fossil fuel prices due to reduced consumption. |

| Technological Innovations | Can lead to cost reductions in renewable energy, impacting overall market prices. |

In addition to these factors, technological innovations in energy production and storage are transforming the market landscape. New technologies can lower costs, but they also create volatility in commodity prices as the market adjusts to these advancements. For example, breakthroughs in battery storage technology can make renewable energy more reliable, encouraging wider adoption and potentially driving down prices in the long run.

However, the transition is not without its challenges. Market speculation surrounding climate-related events can lead to price volatility in commodities. Traders often react to forecasts and trends, impacting prices based on perceived risks associated with climate change. This speculative behavior can exacerbate price fluctuations, making it difficult for consumers and businesses to predict energy costs.

In conclusion, understanding the intricate relationship between energy prices and climate change is essential for navigating the future energy landscape. As we move towards a more sustainable world, the interplay between traditional and renewable energy sources will continue to shape the market. The challenge lies in balancing these dynamics to ensure energy remains accessible and affordable while addressing the urgent need for sustainability.

Renewable Energy Adoption

The transition to renewable energy is not just a trend; it’s a revolution that’s reshaping our world. As we face the undeniable impacts of climate change, the urgency to adopt sustainable energy sources has never been more critical. Imagine a world where the sun powers your home, and the wind fuels your car—this is not science fiction; it's our rapidly approaching reality. The adoption of renewable energy sources like solar, wind, and hydroelectric power is creating a ripple effect across various sectors, especially in commodity pricing.

As demand for renewable energy increases, traditional fossil fuels are experiencing a shift in their market dynamics. For instance, the cost of coal and oil is influenced by the rise of cleaner alternatives. This shift is not only beneficial for the environment but also serves to stabilize and sometimes lower prices for consumers in the long run. However, the transition is not without its challenges. The initial investments in renewable technologies can be high, leading to short-term price volatility in energy commodities.

Moreover, government policies play a significant role in this transition. Many countries are implementing incentives to encourage the adoption of renewable energy. These policies can include tax breaks for solar panel installations or subsidies for wind farms, which can profoundly impact the market. For example, a recent analysis showed that countries with strong renewable energy policies experienced a 20% decrease in fossil fuel prices over five years, as shown in the table below:

| Country | Renewable Energy Policy Change | Fossil Fuel Price Change (%) |

|---|---|---|

| Germany | Increased subsidies for solar energy | -25% |

| United States | Tax incentives for wind energy | -15% |

| China | Investment in hydroelectric projects | -20% |

Technological innovations are also a game changer in the renewable energy sector. Advances in energy storage, such as batteries, are making it easier to harness and utilize renewable energy. This means that even when the sun isn’t shining or the wind isn’t blowing, we can still access power generated from these sources. As these technologies become more widespread, we can expect to see fluctuations in commodity prices. For instance, as storage technologies improve, the demand for lithium—a key component in batteries—has surged, leading to increased prices in that market.

In conclusion, the adoption of renewable energy is a multifaceted issue that significantly influences commodity prices. As we navigate through this transition, it’s essential to stay informed about the changes in energy markets and how they relate to broader economic trends. The future is bright, but it requires our collective effort to embrace these changes for a sustainable tomorrow.

- What are the main types of renewable energy? The primary types include solar, wind, hydroelectric, geothermal, and biomass energy.

- How does renewable energy impact commodity prices? The shift towards renewable energy can lead to decreased demand for fossil fuels, affecting their prices. Additionally, increased demand for materials used in renewable technologies can drive up prices for those commodities.

- Are there government incentives for adopting renewable energy? Yes, many governments offer tax breaks, subsidies, and other incentives to encourage the adoption of renewable energy technologies.

- What role do technological innovations play in renewable energy adoption? Technological advancements improve efficiency and reduce costs in renewable energy production and storage, making it more accessible and affordable.

Government Policies

Government policies play a crucial role in shaping the landscape of energy prices and, consequently, commodity pricing. As nations grapple with the realities of climate change, they are increasingly implementing regulations aimed at reducing carbon emissions. These policies can range from imposing carbon taxes to providing incentives for renewable energy adoption. Such measures not only aim to curb greenhouse gas emissions but also influence the cost structures of various industries, particularly those reliant on fossil fuels.

For instance, when a government introduces a carbon tax, it effectively raises the cost of producing energy from fossil fuels. This increase is typically passed down to consumers, resulting in higher prices for electricity and heating. As a result, industries that depend heavily on these energy sources must either absorb the costs or pass them on to their customers, leading to a ripple effect across the economy. The energy market becomes a battleground where traditional fossil fuels compete against emerging renewable sources, creating a dynamic environment that can lead to significant price fluctuations.

Moreover, government policies can stimulate investment in renewable energy technologies, which can further disrupt traditional commodity markets. For example, subsidies for solar and wind energy can reduce the demand for coal and natural gas, thereby lowering their prices. However, this shift can also lead to increased costs for materials used in renewable technologies, such as lithium for batteries or rare earth elements for solar panels. The interconnectedness of these markets means that changes in policy can have far-reaching implications, not just for energy prices but for the broader commodity landscape.

To illustrate the impact of government policies on commodity prices, consider the following table that summarizes key regulations and their effects:

| Policy Type | Description | Impact on Commodity Prices |

|---|---|---|

| Carbon Tax | A tax imposed on companies for their carbon emissions. | Increases fossil fuel prices, raising costs for consumers. |

| Renewable Energy Subsidies | Financial incentives for companies to invest in renewable energy. | Reduces demand for fossil fuels, lowering their prices. |

| Emission Regulations | Limits on the amount of greenhouse gases that can be emitted. | Increases production costs for high-emission industries. |

In summary, government policies are a double-edged sword in the realm of commodity pricing. While they are essential for driving the transition to a sustainable future, they also introduce complexities that can lead to increased costs and market volatility. As we move forward, it will be vital for policymakers to strike a balance between environmental responsibility and economic stability, ensuring that the transition to cleaner energy does not unduly burden consumers and businesses alike.

- How do government policies affect energy prices? Government policies such as carbon taxes and renewable energy subsidies can significantly alter the cost structures of energy production, leading to fluctuations in energy prices.

- What is the impact of renewable energy adoption on commodity prices? The shift towards renewable energy can decrease demand for fossil fuels, affecting their prices while also increasing the costs of materials needed for renewable technologies.

- Are there any negative effects of government regulations? Yes, while regulations aim to protect the environment, they can also lead to increased operational costs for businesses, which may be passed on to consumers through higher prices.

Technological Innovations

In the ever-evolving landscape of energy production and consumption, play a pivotal role in shaping commodity prices. As we navigate through the challenges posed by climate change, advancements in technology are not just enhancing efficiency; they are also redefining the very fabric of our energy market. Imagine a world where energy is not just abundant but also clean and affordable. This vision is becoming a reality, thanks to breakthroughs in renewable energy technologies, energy storage solutions, and smart grid systems.

One of the most significant innovations has been in the realm of renewable energy sources. Solar panels and wind turbines have become more efficient and cost-effective, leading to a surge in their adoption. As these technologies improve, the reliance on fossil fuels diminishes, which can lead to a decrease in their prices. However, this transition is not without its challenges. The initial investment in renewable technologies can be high, and the market reacts to these fluctuations. For instance, the cost of solar energy has dropped dramatically over the past decade, yet the market can experience volatility as new technologies are introduced.

Furthermore, advancements in energy storage are crucial for addressing the intermittent nature of renewable sources. Battery technologies, such as lithium-ion and emerging solid-state batteries, are revolutionizing how we store energy. This innovation not only allows for better management of energy supply but also stabilizes prices in the market. With more efficient storage solutions, the energy produced during peak sunlight hours can be stored and used when demand is highest, reducing the need for costly peak-time energy production.

Moreover, the rise of smart grid technology is transforming the way energy is distributed and consumed. Smart grids utilize digital communication technology to monitor and manage the transport of electricity from all generation sources to meet the varying electricity demands of end users. This innovation helps reduce energy waste, enhances reliability, and allows for more dynamic pricing models. For consumers, this means the potential for lower energy bills and for the market, it means a more stable pricing environment.

However, while these innovations promise lower costs and increased efficiency, they also introduce a level of market volatility. As new technologies emerge, existing energy markets may face disruption. For instance, the rapid adoption of electric vehicles (EVs) is increasing demand for electricity, which can lead to price spikes if supply does not keep pace. This dynamic creates a complex interplay between supply and demand that can cause fluctuations in commodity prices.

In summary, technological innovations are both a boon and a challenge for the energy market. They hold the potential to lower costs and improve sustainability, but they also introduce new variables that can lead to price volatility. As we continue to innovate and adapt to the realities of climate change, understanding these dynamics will be crucial for consumers, businesses, and policymakers alike.

- How do technological innovations affect energy prices?

Technological innovations often lead to increased efficiency and reduced costs in energy production, which can lower prices. However, they can also introduce market volatility as new technologies disrupt existing systems.

- What role do renewable energies play in commodity pricing?

Renewable energies, when adopted widely, can decrease the demand for fossil fuels, leading to lower prices for those commodities. However, the transition period can cause fluctuations in prices.

- Can technological advancements lead to energy shortages?

While technological advancements typically aim to enhance efficiency, sudden shifts in demand (like the rise of electric vehicles) can create temporary shortages if supply does not keep pace.

Market Speculation

Market speculation is a fascinating yet complex aspect of the commodities market, especially in the context of climate change. When traders hear about unusual weather patterns or forecasts predicting extreme conditions, they often react swiftly, buying or selling commodities based on perceived risks. This reaction can lead to significant price fluctuations, sometimes even before the actual impact of these climate events is felt. It's almost like watching a game of chess where every player is trying to anticipate the opponent's next move, but in this case, the opponent is the unpredictable nature of our climate.

For instance, if a drought is forecasted in a major agricultural region, traders might rush to purchase grain futures, anticipating a shortage. This rush can create a self-fulfilling prophecy: as prices rise due to speculation, it can lead to actual increases in costs for consumers and businesses alike. The emotional aspect of trading—fear and greed—plays a huge role here. Traders often rely on technical analysis and market sentiment to guide their decisions, which can sometimes lead to irrational price swings that don't necessarily reflect the underlying supply and demand fundamentals.

Moreover, the influence of social media and real-time news has amplified this phenomenon. In today's digital age, information spreads like wildfire. A single tweet about a potential storm can send commodity prices soaring or plummeting within minutes. This volatility can be bewildering, as prices may not align with the actual market conditions. For example, during the COVID-19 pandemic, we saw how quickly market sentiment could shift, leading to drastic changes in commodity prices across the board.

To further illustrate the impact of market speculation on commodity prices, consider the following table that highlights recent trends in commodity prices alongside significant climate-related events:

| Commodity | Price Change (%) | Event |

|---|---|---|

| Corn | +15% | Drought in the Midwest |

| Crude Oil | -10% | Hurricane disrupting supply |

| Wheat | +20% | Flooding in key production regions |

This table succinctly captures how closely linked commodity prices are to climate events and the speculation that surrounds them. The uncertainty and fear of potential shortages drive traders to react quickly, often leading to inflated prices. It's a cycle that can be difficult to break, causing stress not only for traders but also for consumers who ultimately bear the brunt of these price increases.

In summary, market speculation is a critical driver of commodity prices in the face of climate change. As we continue to navigate an increasingly volatile climate, understanding the dynamics of speculation becomes essential for anyone involved in the commodities market. Whether you're a trader, a business owner, or a consumer, recognizing how speculation can influence prices will help you make more informed decisions in this unpredictable landscape.

- What is market speculation? Market speculation refers to the act of buying or selling commodities based on predictions of future price movements rather than the current value.

- How does climate change affect commodity prices? Climate change leads to unpredictable weather patterns that can disrupt supply chains and agricultural yields, causing price fluctuations.

- Why do traders react quickly to climate news? Traders often react quickly due to the fear of missing out on potential profits or losses, driven by the uncertainty surrounding climate-related events.

- Can market speculation lead to price inflation? Yes, speculation can inflate prices as traders buy into commodities they believe will be in short supply, regardless of the actual market conditions.

Water Scarcity and Commodity Prices

Water scarcity, a growing concern exacerbated by climate change, is reshaping the landscape of commodity prices across the globe. As the climate continues to shift, regions that once enjoyed abundant water resources are experiencing unprecedented droughts and water shortages. This scarcity not only threatens the availability of drinking water but also has far-reaching implications for industries that rely heavily on water, particularly agriculture and energy. The ripple effect of dwindling water supplies can lead to a surge in costs for essential commodities, making it an issue that demands our attention.

In agriculture, water is the lifeblood of crop production. Farmers depend on consistent water supply for irrigation, and as water becomes scarce, the costs associated with irrigation systems and crop management rise dramatically. For instance, in areas facing severe drought, farmers may have to invest in advanced irrigation technologies or even resort to purchasing water, driving up their operational costs significantly. These increased costs are often passed on to consumers, resulting in higher prices for staple foods and other agricultural products. The following table illustrates the relationship between water availability and crop yields in various regions:

| Region | Water Availability (liters per capita) | Average Crop Yield (tons per hectare) |

|---|---|---|

| Region A | 1500 | 3.5 |

| Region B | 800 | 2.0 |

| Region C | 400 | 1.2 |

Moreover, the industrial sector is not immune to the impacts of water scarcity. Industries that rely on water for production processes face significant challenges as competition for this vital resource intensifies. Companies may find themselves in bidding wars for water rights, which can lead to skyrocketing operational costs. This situation is particularly evident in sectors such as manufacturing and energy production, where water is essential for cooling processes or generating steam. As these costs rise, businesses may be forced to increase their prices, contributing to inflation in commodity markets.

The interconnection between water scarcity and commodity prices is further complicated by the geopolitical landscape. Regions that experience water shortages may face increased tensions, leading to conflicts over water rights and resources. Such conflicts can disrupt supply chains and lead to further price increases as commodities become scarcer. In essence, water scarcity not only impacts the immediate costs of goods but also creates a volatile market environment where prices can fluctuate wildly based on perceived risks and actual water availability.

In conclusion, water scarcity is a formidable force driving up commodity prices, and its impacts are felt across various sectors. As we continue to grapple with the effects of climate change, it is crucial for policymakers, businesses, and consumers alike to recognize the importance of sustainable water management practices. By addressing water scarcity proactively, we can mitigate its effects on commodity prices and work towards a more resilient and sustainable future.

- What is water scarcity? Water scarcity refers to the lack of sufficient available water resources to meet the demands of water usage within a region.

- How does water scarcity affect commodity prices? Water scarcity increases the costs of agricultural production and industrial operations, leading to higher prices for various commodities.

- What industries are most affected by water scarcity? Agriculture and energy are among the most affected industries due to their high dependence on water resources.

- What can be done to mitigate the effects of water scarcity? Implementing sustainable water management practices, investing in water-efficient technologies, and promoting conservation can help address water scarcity issues.

Agricultural Water Use

Water is often referred to as the lifeblood of agriculture, and for good reason. It plays a vital role in the growth and development of crops, influencing everything from seed germination to harvest yields. With climate change intensifying, the availability of this precious resource is becoming increasingly uncertain. As temperatures rise and weather patterns shift, many regions are experiencing decreased rainfall and prolonged droughts, which directly impact agricultural productivity.

Farmers are now facing the daunting challenge of managing their water resources more efficiently. This has led to a surge in the adoption of advanced irrigation techniques, such as drip irrigation and rainwater harvesting. These methods not only conserve water but also enhance crop yields by delivering moisture directly to the plant roots. However, the initial investment in these technologies can be significant, which may deter some farmers, particularly those operating on tighter budgets.

Moreover, the rising costs associated with water usage are forcing farmers to rethink their strategies. As water becomes scarcer, the price of irrigation can skyrocket, leading to increased operational costs. This situation is further exacerbated by the fact that many crops require substantial amounts of water to thrive. For instance, it takes approximately 1,800 gallons of water to produce just one pound of beef, highlighting the water-intensive nature of certain agricultural practices.

To illustrate the impact of water scarcity on agricultural practices, consider the following table:

| Crop Type | Water Requirement (gallons per pound) | Impact of Water Scarcity |

|---|---|---|

| Rice | 2,500 | Reduced yields, higher prices |

| Wheat | 1,500 | Lower quality, increased costs |

| Almonds | 1,900 | Higher production costs, market volatility |

| Beef | 1,800 | Increased prices, potential shortages |

As the table indicates, different crops have varying water requirements, and the pressures of climate change are making it increasingly difficult to meet these needs. Farmers are not only battling the elements but also the market dynamics that arise from these challenges. For example, as water becomes more expensive, the cost of food inevitably rises, impacting consumers and leading to greater food insecurity.

In light of these challenges, it is essential for farmers, policymakers, and consumers to work together to develop sustainable solutions. This could include investing in water-efficient technologies, implementing better water management practices, and promoting policies that support conservation efforts. By prioritizing the sustainable use of water resources, we can help ensure that agriculture remains viable in the face of climate change.

- How does climate change affect agricultural water use?

Climate change leads to altered rainfall patterns and increased temperatures, which can result in reduced water availability for irrigation. - What are some water-saving techniques for farmers?

Farmers can adopt methods like drip irrigation, rainwater harvesting, and soil moisture sensors to optimize water use. - Why is water scarcity a concern for food prices?

As water becomes scarcer, the costs of irrigation increase, leading to higher production costs and ultimately higher food prices.

Industrial Water Demand

Water is the lifeblood of many industries, serving as a critical resource in production processes ranging from manufacturing to energy generation. As climate change intensifies, the demand for water in industrial applications is becoming increasingly strained. Industries such as textiles, food processing, and electronics require substantial amounts of water for their operations, and with the growing threat of water scarcity, the competition for this precious resource is heating up.

To put this into perspective, consider that the textile industry alone consumes approximately 93 billion cubic meters of water annually, which is enough to fill over 37 million Olympic-sized swimming pools. As climate change alters precipitation patterns and increases the frequency of droughts, industries are forced to adapt to a new reality where water availability is no longer guaranteed. This situation not only threatens production capabilities but also leads to a ripple effect across the supply chain, ultimately impacting commodity prices.

Furthermore, industries that rely heavily on water are increasingly facing higher operational costs due to the need for more efficient water management practices. This includes investments in recycling technologies and water-efficient processes. As companies scramble to secure their water supply, the costs associated with procurement and conservation efforts can skyrocket. For instance, businesses may need to shift towards advanced water treatment technologies, which, while beneficial in the long run, often come with hefty price tags. The combination of rising demand and dwindling supply can create a perfect storm that drives commodity prices higher.

In addition, the competition for water extends beyond individual industries. Various sectors are vying for limited water resources, leading to conflicts and increased costs. For example, agricultural operations may compete with industrial needs, creating a tug-of-war over water allocation. This scenario can lead to regulatory changes and increased prices for water, which ultimately trickle down to consumers in the form of higher commodity prices.

Overall, the interplay between industrial water demand and climate change is complex and multifaceted. As industries grapple with the realities of water scarcity, the implications for commodity prices are profound. Companies that can adapt to these changes and implement sustainable practices will not only mitigate risks but also position themselves favorably in a market increasingly defined by environmental challenges.

- How does climate change affect industrial water demand?

Climate change alters precipitation patterns and increases the frequency of droughts, leading to water scarcity. This scarcity forces industries to compete for limited water resources, driving up operational costs and commodity prices.

- What industries are most affected by water scarcity?

Industries such as textiles, food processing, and electronics are particularly affected due to their high water consumption. These sectors must adapt to the challenges posed by climate change to maintain production levels.

- What measures can industries take to manage water scarcity?

Industries can implement water-efficient technologies, recycle water, and invest in sustainable water management practices to reduce their dependence on freshwater resources.

Global Supply Chain Disruptions

Climate change is not just a distant threat; it’s a reality that is reshaping the very fabric of our global supply chains. The increasing frequency and intensity of climate-related events, such as hurricanes, floods, and droughts, are creating a ripple effect that can disrupt the availability of raw materials and essential goods. Imagine a delicate web where each strand represents a different aspect of production and distribution. Now, picture that web being tugged at and frayed by the forces of nature—this is precisely what’s happening. The consequences can lead to shortages, increased costs, and ultimately, higher prices for consumers across the board.

Natural disasters, often linked to climate change, can wreak havoc on transportation networks, making it difficult for goods to reach their destinations. When a hurricane strikes a coastal city, for instance, ports can be closed, and shipping routes can be disrupted for days or even weeks. This not only affects the immediate area but can have a domino effect on the entire supply chain. According to a recent report, over 60% of companies experienced supply chain disruptions due to extreme weather events in the past year alone. This statistic underscores the urgency of addressing climate impacts on logistics and distribution.

Moreover, the geopolitical landscape is also being influenced by climate change. Countries facing severe weather conditions may impose trade restrictions or tariffs to protect their own resources. This can lead to heightened competition for limited commodities, further complicating the global supply chain. For example, if a major agricultural producer faces drought, it may reduce exports, thereby increasing prices in importing countries. The interconnectedness of our global economy means that disruptions in one region can lead to price hikes worldwide.

To illustrate the impact of these disruptions on commodity prices, consider the following table:

| Commodity | Impact of Climate-Related Disruptions | Price Increase (%) |

|---|---|---|

| Wheat | Reduced yields due to drought | 25% |

| Coffee | Damage from extreme weather | 30% |

| Oil | Disruptions in transportation | 15% |

As we navigate these challenges, it’s crucial for businesses and governments to implement strategies that enhance resilience against climate-related disruptions. This could involve investing in infrastructure that can withstand extreme weather, diversifying supply sources, or even adopting more sustainable practices that reduce reliance on vulnerable supply chains. The goal is not just to survive but to thrive in a world where climate change is an ever-present factor.

In conclusion, the impact of climate change on global supply chains is profound and multifaceted. As we witness more frequent disruptions, it becomes increasingly clear that adapting to these changes is not an option but a necessity. The future of commodity prices hinges on our ability to respond effectively to the challenges posed by a changing climate.

- How does climate change affect commodity prices?

Climate change leads to disruptions in supply chains, affecting agricultural yields and energy prices, which in turn increases the cost of commodities. - What role do natural disasters play in supply chain disruptions?

Natural disasters can halt production and transportation, leading to shortages and increased prices for goods. - Are there any strategies to mitigate the impact of climate change on supply chains?

Yes, businesses can invest in resilient infrastructure, diversify suppliers, and adopt sustainable practices to reduce vulnerability.

Natural Disasters

Natural disasters, increasingly linked to climate change, have become a significant concern for economies worldwide. These catastrophic events—ranging from devastating hurricanes to prolonged droughts—can wreak havoc on local and global supply chains, leading to a ripple effect that impacts commodity prices across various sectors. Imagine a hurricane making landfall; it not only disrupts the immediate area but also sends shockwaves through markets, causing prices to rise due to anticipated shortages. The unpredictability of these disasters creates an environment of uncertainty, making it challenging for businesses and consumers alike to plan for the future.

For instance, when a major agricultural region is struck by a natural disaster, the consequences can be dire. Crop failures lead to reduced supply, which in turn drives up prices. This scenario is not just hypothetical; it has occurred numerous times in recent years. A prime example is the 2017 hurricanes that devastated parts of the Caribbean and the southern United States. The aftermath saw significant increases in prices for commodities like sugar and corn, as production was severely hampered. The correlation between natural disasters and commodity prices is clear, as seen in the table below:

| Year | Disaster | Commodity Affected | Price Increase (%) |

|---|---|---|---|

| 2017 | Hurricane Harvey | Corn | 15% |

| 2018 | California Wildfires | Almonds | 20% |

| 2020 | Hurricane Laura | Sugar | 10% |

Moreover, the effects of natural disasters extend beyond immediate price spikes. The long-term implications can be just as severe. Disasters can lead to infrastructure damage, making it difficult for producers to transport goods to market. This disruption can create bottlenecks, further exacerbating price increases. Additionally, as regions become more prone to such events, investors may become wary, leading to volatility in commodity markets. The perception of risk can trigger speculative trading, which can further inflate prices.

In conclusion, the link between natural disasters and commodity prices is a complex web of cause and effect. As climate change continues to intensify, the frequency and severity of these disasters are likely to increase, posing a significant challenge for global markets. Understanding this relationship is crucial for stakeholders, as it can inform better strategies for risk management and pricing in an increasingly unpredictable world. With the stakes so high, one might wonder: how can we better prepare for these inevitable disruptions? The answer lies in proactive measures, including investing in resilient infrastructure and adopting sustainable practices that can mitigate the impacts of climate change.

- How do natural disasters affect commodity prices? Natural disasters can disrupt production and supply chains, leading to shortages and increased prices for affected commodities.

- Are all commodities equally affected by natural disasters? No, the impact varies by commodity type and the region affected by the disaster.

- What can businesses do to mitigate risks from natural disasters? Companies can invest in resilient infrastructure and diversify their supply chains to reduce vulnerability.

- How does climate change influence the frequency of natural disasters? Climate change is linked to increased weather extremes, which can lead to more frequent and severe natural disasters.

Geopolitical Risks

In today's interconnected world, have become a significant factor affecting commodity prices. As nations grapple with the impacts of climate change, tensions often rise, leading to unpredictable market dynamics. For instance, countries that are heavily reliant on fossil fuels may find themselves at odds with those pushing for renewable energy adoption. This friction can lead to trade restrictions, tariffs, or even outright embargoes, all of which can disrupt the flow of essential commodities.

Consider the scenario where a major oil-producing nation faces political unrest due to climate-related issues, such as severe droughts or hurricanes. This unrest can lead to a decrease in oil production, causing prices to soar globally. The ripple effects can be felt across various sectors, from transportation to manufacturing, as businesses scramble to secure alternative supplies. The result? A significant uptick in costs for consumers and businesses alike.

Moreover, the competition for resources like water and arable land is intensifying as climate change alters the landscape. Nations may find themselves in conflict over these dwindling resources, further complicating the global supply chain. For example, countries that depend on agricultural imports may experience price hikes as exporting nations prioritize their domestic needs over international trade. This scenario not only affects food prices but can also lead to broader economic instability.

To illustrate the impact of geopolitical risks on commodity prices, consider the following table:

| Event | Impact on Commodity Prices |

|---|---|

| Political Unrest in Oil-Producing Nations | Increased oil prices due to supply disruptions |

| Trade Tariffs on Agricultural Products | Higher prices for imported food items |

| Water Scarcity Leading to Agricultural Competition | Increased prices for grains and other crops |

| Climate-Induced Natural Disasters | Supply chain bottlenecks leading to price spikes |

As we move forward, it is crucial for businesses and consumers to stay informed about these geopolitical risks. Understanding the interplay between climate change and international relations can help anticipate market fluctuations and prepare for potential price increases. After all, in a world where the stakes are high, knowledge is power.

- How does climate change affect commodity prices?

Climate change leads to unpredictable weather patterns, impacting agricultural yields and increasing production costs, which ultimately drives up commodity prices. - What role do government policies play in commodity pricing?

Government regulations aimed at reducing carbon emissions can increase costs for fossil fuels, incentivizing a shift toward renewable energy and affecting the overall commodity market. - How can geopolitical risks influence the availability of commodities?

Geopolitical tensions can lead to trade restrictions and conflicts over resources, disrupting supply chains and causing price volatility.

Frequently Asked Questions

-

How does climate change affect agricultural prices?

Climate change disrupts weather patterns and agricultural productivity, leading to fluctuating crop yields. Extreme weather events like droughts and floods can devastate harvests, resulting in reduced supply and higher prices for essential commodities.

-

What impact does renewable energy have on commodity prices?

The transition to renewable energy sources alters the demand for traditional fossil fuels. As more investments flow into sustainable alternatives, the costs associated with fossil fuels may rise, affecting overall commodity prices in the energy market.

-

Can government policies influence commodity prices?

Absolutely! Government regulations aimed at reducing carbon emissions can increase costs for fossil fuels, which in turn affects commodity prices. These policies can incentivize a shift toward renewable energy, further impacting market dynamics.

-

What role does market speculation play in commodity pricing?

Market speculation can create significant price volatility. Traders often react to climate-related forecasts and trends, impacting prices based on perceived risks. This can lead to rapid fluctuations in commodity prices as market sentiments shift.

-

How does water scarcity affect commodity prices?

Water scarcity, worsened by climate change, increases costs for agriculture and industries reliant on water. As competition for water resources intensifies, the operational costs rise, leading to higher prices for commodities dependent on water supply.

-

What are the consequences of natural disasters on supply chains?

Natural disasters linked to climate change can severely disrupt global supply chains, creating bottlenecks in transportation and production. This disruption often leads to increased costs for both consumers and businesses, driving commodity prices higher.

-

How do geopolitical risks relate to climate change and commodity prices?

Geopolitical tensions exacerbated by climate-related issues can complicate global supply chains. Countries may impose trade restrictions or tariffs in response to climate challenges, which can further drive up commodity prices due to reduced availability.